What is a business owners policy (BOP)?

A business owners policy (BOP) is a comprehensive insurance package that combines general liability and property insurance into one policy. This bundled package helps protect business assets like buildings, furniture, or equipment from fire, theft, or weather damage. It also provides coverage for business-related actions such as injury to a third party, property damage to someone else’s property, and personal and advertising injury.

Why do I need it?

Business owners often choose this policy because it combines essential coverage like general liability and property insurance. Bundling these coverages into one policy can lead to significant cost savings compared to purchasing them separately. A business owner’s policy offers customization options, allowing them to tailor their coverage with specific enhancements to suit their unique needs. This tailored protection gives business owners peace of mind, enabling them to focus on running their business.

How much does it cost?

The cost of a business owner’s policy (BOP) depends on several factors, including your location, the number of employees, and the level of risk your business faces. Request a free quote to get an accurate estimate tailored to your business!

What does a business owner’s policy typically cover?

At Acuity, we believe protecting your business is a partnership. Acuity’s business owner’s policy helps protect business assets, including:

Property

-

Building

-

Furniture, fixtures, machinery, and equipment

-

Inventory

-

Property belonging to others

Liability

-

Bodily injury to a third party

-

Property damage to someone else’s property

-

Personal and advertising injury

-

Medical payments for small claims that cause injury without establishing that the insured was at fault

What type of events can a business owner's policy help pay for?

Businesses face various risks, and a business owner’s policy can provide coverage for many. Here are some examples of situations where Acuity’s BOP could help your business.

-

Fire damage: If a fire breaks out in your building, leading to damage to the structure, computers, or furniture.

-

Power failure and changes in temperature: If a refrigerator unit fails to maintain its temperature, leading to spoilage of perishable inventory.

-

Valuable papers and records: If a fire or flood damages valuable papers or records like medical or legal documents.

-

Medical bills: If a delivery person or customer trips and falls, resulting in an injury.

-

Legal defense costs: If a client takes you to court claiming you breached your contract, even if that case is unfounded.

-

Rental property damage repair costs: If there is accidental damage to your leased office space.

-

Settlements and judgments: If your business is found liable in court and a customer is awarded a settlement, it is covered up to the policy limit.

Acuity’s optional coverages

Along with the business owner’s policy, Acuity offers several optional coverages to address common gaps and ensure your business is well-protected.

-

Bis-Pak® full building replacement cost. It helps protect you by determining the cost to reconstruct your building before a loss, guaranteeing you have adequate building limits if a loss occurs.

-

Additional insured. Acuity offers an extensive portfolio of additional insured endorsements to meet the requirements of the contracts you sign.

-

Employment-related practices liability insurance. Protects against claims from employees for allegations their legal rights have been violated.

-

Errors and omissions/professional liability. Protects against misrepresentation, breach of professional services, wrongful business practices, misleading advice, and conflict of interest.

What does it not cover?

While the business owner’s policy offers broad protection for your primary business location, you may need additional coverage for the following.

Workers' Compensation provides benefits to employees who suffer work-related injuries or illnesses. Acuity offers workers’ compensation insurance to ensure your employees can get back to work.

Inland Marine helps if your business has property that is in transit or stored away from your main location. Examples include contractor's iequipment, tools, inventory in transit, or property used in construction. .

Business Property protects your company’s physical assets against damage or loss due to various risks. Acuity can help protect your building and contents with our business property insurance.

Crime and Fidelity protects your company from financial losses due to dishonest acts by employees or other trusted individuals. Acuity offers crime and fidelity coverage to protect your business from these crimes.

Acuity’s specialized Bis-Pak plans

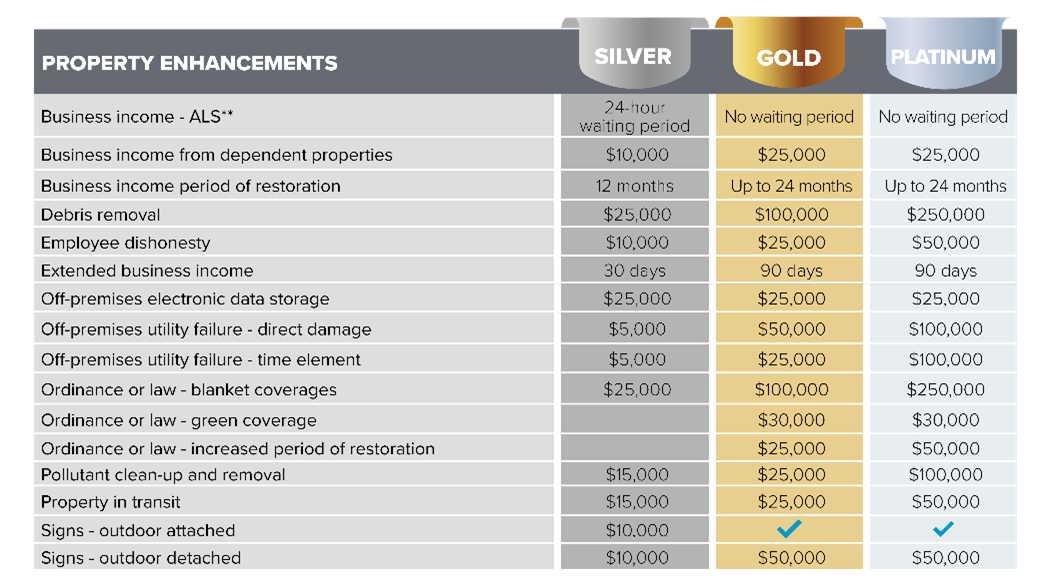

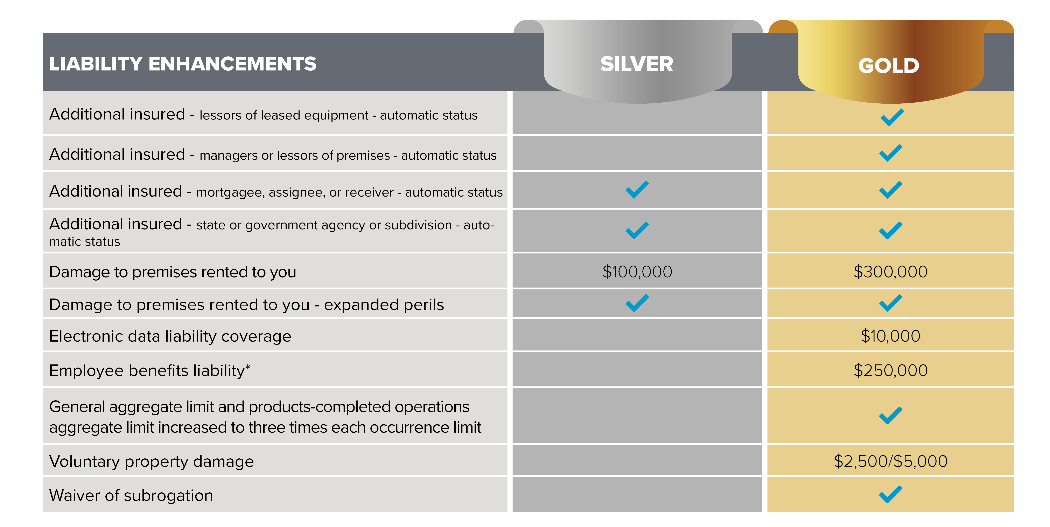

Acuity provides Bis-Pak plans tailored for manufacturers, contractors, and other small businesses. You can add property and liability enhancements to make your business owner’s policy even more robust.

Acuity’s Bis-Pak enhancements come in three tiers, each available at a significantly discounted price.

Full list of property enhancements

Full list of liability enhancements

OSHA 10-hour training

Offered at no cost to our insureds, OSHA training is available throughout our operating territory if you have 15 or more people to train. You and your employees can learn how to prevent, recognize, and control various safety and health hazards.

Who needs a business owner’s policy?

Retail

Wholesalers and distributors

Services businesses

Restaurants

Auto repair shops

Landlord & rental properties

Commercial auto insurance

Does your business rely on vehicles to get work done? When an employee is involved in an auto accident our commercial auto insurance protects your business. Acuity would love to keep you working and on the road.

Workers' Compensation

No business owner wants to see his or her employees get injured on the job. Rest assured that with Acuity’s workers’ compensation insurance, when an injury does occur, we will take care of your employee by getting them the help they need so they can get back to work.

Equipment Breakdown

Equipment breakdown coverage is no longer simply for your boiler and machinery. Learn about all of the things that Acuity's equipment breakdown can cover.

FAQs

Have questions? We have answers.

What is the difference between a BOP and a general liability policy?

A business owners policy offers broader protection, including liability, property, and other coverages. A general liability policy protects against lawsuits from third parties, bodily injuries, damage to customers' property, and advertising claims.

Will a business owner’s policy help pay damages from natural disasters?

A BOP provides coverage for many natural disasters, but it may not cover all events. Businesses should be aware of what is covered with their policy and customize it with additional coverages to ensure protection against risks in their area.

Can I change my business owner’s policy as my business grows?

Yes, Acuity wants to ensure your business is well-protected as you grow. Let us know how we can help adjust your policy to meet your business’s changing needs, whether adding new coverage or increasing coverage limits.

Does a BOP cover equipment breakdown?

No, the standard business owner’s policy does not cover equipment breakdown. However, Acuity does offer coverage for such events with our equipment breakdown policy.

Get a quote

Get an accurate insurance quote in just a few minutes.

Find an agent

We partner with independent agents who are committed to your needs.

Talk with someone

When you call, a helpful Acuity employee will answer. Call us at 800.242.7666

Create/access your account

View your policies, track claims, pay your bill, and more.